Rud pulls are a common thing when it comes to the crypto space but in 2024 we have seen a lot of rise in similar schemes when it comes to prop firms. I have been trading prop firms for the past 1 and a half years with the knowledge I’ve got over the years I will help you find a reliable prop firm.

In this article, I will tell you everything you need to look for when choosing a prop firm and what to avoid, tools you need to use in order to find a reliable prop firm

What Is A Rug Pull In Prop Firms

A Prop Firm Rug Pull usually happens when a firm launches aggressive sales campaigns to attract traders, offering 50%–90% off evaluation fees. Within weeks of these campaigns, the firm shut down operations, blaming financial or regulatory challenges, leaving traders unpaid

That is why I have written this article to avoid falling victim to scammy prop firms that have a high chance of doing rug pull.

How to Identify a Trustworthy Prop Firm

Finding a trustworthy prop firm can be challenging but it doesn’t have to be. By knowing what to look for and taking some time to research, you can avoid scam prop firms and find a firm that genuinely supports trades.

Here are some tips I’ve found helpful:

- Read Their Rules

- Read Reviews Trustpillot

- Doest Consistently Run 50% to 90% Discounts

- Have FAQs with Transparent Terms & Conditions

- Check Their Discord Public Charts If There are Any Complains

- Regulated or Well-Established (The Longer They Have Been In The Game The better)

By taking these steps, you can feel more confident about choosing a prop firm. Remember, a good prop firm will be professional and trust-oriented. But still, there are more things to look for by using Prop Firm Match Tool in combination with these tips, it will help you find a trustworthy prop firm.

Steps to Find the Best Prop Firm (Using Prop Firm Match)

Finding the best prop firm doesn’t have to be complicated, using a step-by-step approach can make the process simple and straightforward. One way to make your search easy is to use Prop Firm Match, a tool that allows you to narrow down firms based on what you are looking for in a firm. If you are new to Prop Frim Trading first read this Beginner Guide To Prop Firm Trading.

Before jumping into research, take some time to think about your trading goals and preferences. Ask yourself:

- What’s my trading style? (e.g., day trading, swing trading, scalping)

- What instruments do I want to trade? (e.g., forex, stocks, crypto)

- Am I looking for a high-profit split or lower fees?

- Do I prefer specific platforms like MetaTrader 4/5 or TradingView?

Having clear answers will help you ease the process of finding the right prop firm.

Step 1: Prop Firm Research

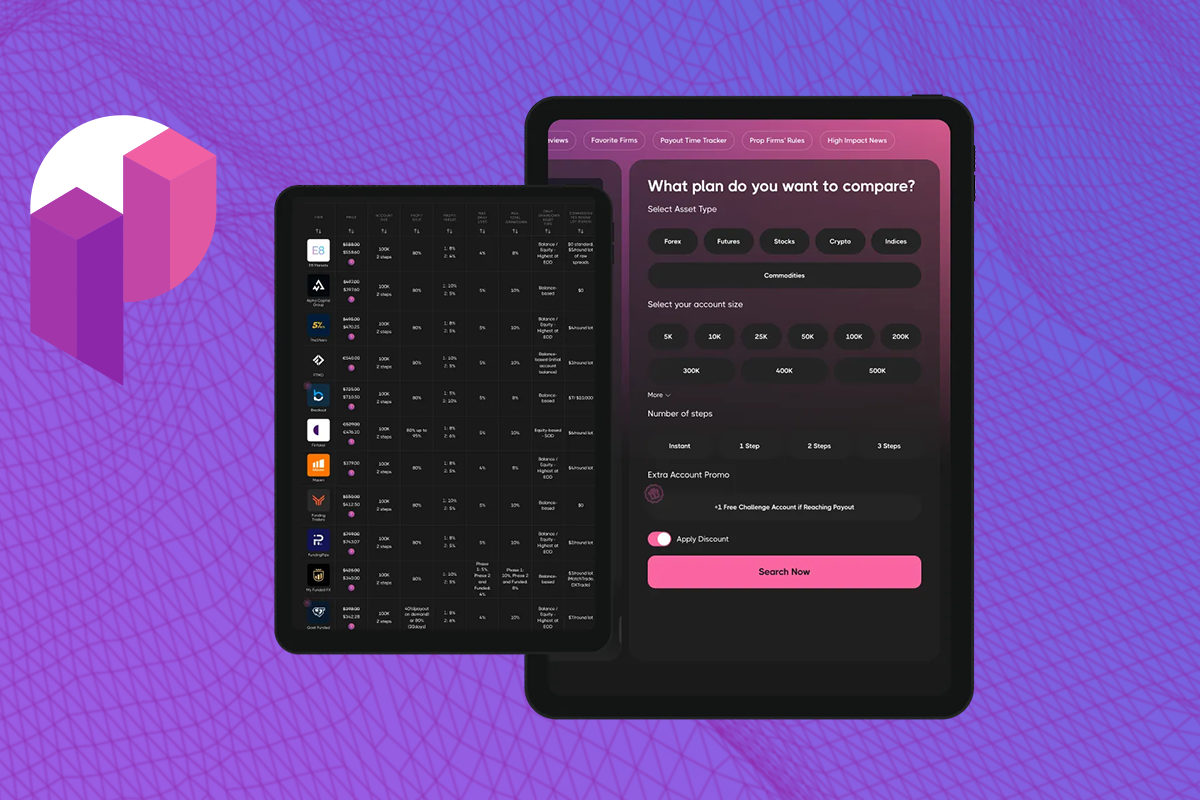

Prop Firm research can be so simple once you have asked yourself the questions above, all you need to do now is to visit Prop Firm Match and filter the firms based on your requirements.

Here is an example, am a day trader who trades forex looking for low fees and high-profit split. My preferred trading platform is Meta Trade 5 and TradingView if available.

Go to Prop Firm March and select these filters

- Your Asset Type e.i Forex, Futures, Stocks, Crypto and Indices

- Account Size e.i Recommend $10K for Beginners

- Number of Steps e.i 2 Step Challenge

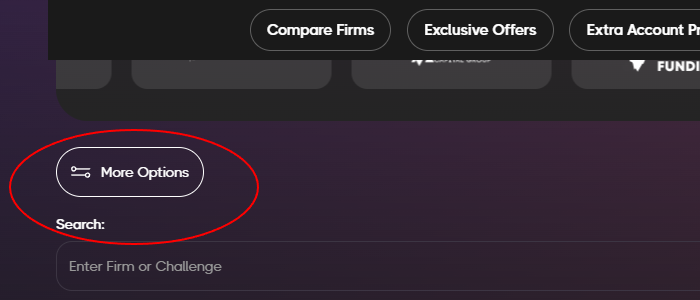

Then you have to click on more options so that Prop Firm Match can give you a lot of filters to use.

- On Features select, In-House Technology and Refund Fee

- On Brokers select Liquidity Provider / Own Broker

- Platform Meta Trader 5

| After this checklist, we are left with 5 prop firms to choose from. |

Prop Firm |

Features |

Ratings |

Price |

|---|---|---|---|

FTMO |

|

|

€89 |

The5%ers |

|

|

$78 |

FundedNext |

|

|

$59 |

Alpha Capital Group |

|

|

$97 |

Audacity Capital |

|

|

$129 |

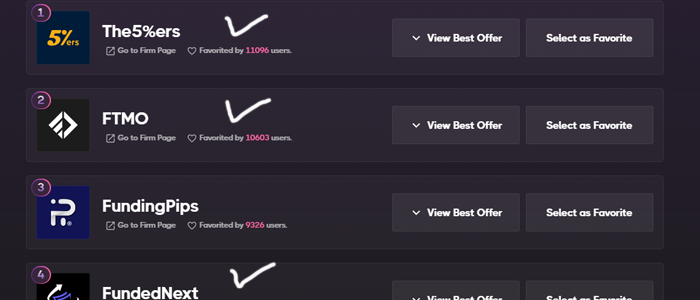

Now you can even go a step further from Prop Firm Match go to Favorite Firms the you will see which prop firms people are already in the prop firm space. As of writing this article, you will see that 3 of our table-filtered lists The5%ers, FTMO, and FundedNext are in the top 5 most loved prop firms.

If you are looking for reliability and affordability just go with The5%ers, it’s one of the best prop firms and ist been around since 2016. It really shows that they are here for business and they are professionals.

Step 2: Check Reviews

Now that you’ve narrowed down your list to 2 or 3 prop firm choices, it’s time to hear from real traders. Look for reviews on trusted platforms like Trustpilot, Prop Firm Match, Discord Server, and X/Twitter.

Here’s what to focus on:

- Are traders being paid on time?

- Is customer support responsive?

- Do traders find the evaluations fair?

Keep an eye out for both positive and negative reviews to get a balanced picture. If you really want to trade prop firms it’s important to have an X/Twitter account so you can easily follow what’s happening in the prop firm space.

Step 3: Understand The Prop Firm Rules

This is the final step to decide which prop firm you are going to trade with. Every prop firm has its own rules but some might cause you to lose your trading challenge or funding. Here are Pro Firm Rules that are important

- Is Copy Trading Allowed

- Is News Trading Allowed

- Is High-Frequency Trading Allowed

- Do You Get a Refund Fee on the First Payout

- How Much Are You Allowed To Risk Per Trade

- Daily Drawdown & Maximum Drawdown

- Phase 1 and Phase 2 Targets

- When are Payouts Made e.i Bi-Weely, Bi-Monthly

- Can You Travel While Trading (IP address changes)

- Is Stop Loss Required

- Is Over Nigh Holding or Weekend Holding Allowed

- Are EAs Allowed

- What Trading Strategies Are Allowed

- Maximum Funds Allocation

Common Prop Firms Red Flags to Avoid Scams

Choosing the wrong prop firm can lead to wasted time, money, and effort. Unfortunately, some firms prey on traders with promises of large funding at cheap prices but lack the transparency and legitimacy needed to back them up.

To avoid scams, watch out for these common red flags:

Poor Online Presence

Reliable firms will usually have a professional website, active social media profiles, and detailed information about their operations. If a company avoids sharing its location, leadership, or even basic details about how it works, that’s a red flag. Legitimate businesses don’t hide their identity.

Lack of Real Evaluations

Trustworthy prop firms will test your trading skills before providing funding. Be cautious of firms offering instant funding without any skill-based assessment, as they may not have the resources or intent to back their promises. A legitimate firm wants to see that you’re ready for the responsibility of managing their funds.

Aggressive Marketing

Scams often use flashy ads and make promises that sound too good to be true, like guaranteed success or instant funding. A trustworthy firm focuses on delivering professional services, not hyped-up sales pitches. If a firm is more about promises than substance, you should be skeptical.

Poor Customer Support

If a firm is hard to reach, avoids answering questions, or offers vague responses, it’s a good idea to avoid them. A trustworthy firm will prioritize helping its traders and will be easy to contact when needed.

Lack of Proof of Funding

Some firms claim they fund traders but don’t actually have the resources to do so. Look for firms that can prove they pay successful traders and have a solid track record of doing so. Reviews, testimonials, and real evidence of payouts are essential when making your choice.

Conclusion

Finding a reliable prop firm requires you to do your own research, don’t be a zombie, and follow what some random dude you find on the internet tells you which is the best prop firm. Usually, this people don’t have the best interest at heart, they just want to get an affiliate commission

Keep these red flags in mind, and if something feels off, trust your instincts. A good prop firm will always be transparent, supportive, and fair in its practices. If All this scares you you can always start trading using forex brokers.

FAQ

Leave a Reply