Forex trading, also known as foreign exchange trading, involves buying and selling currencies to profit from fluctuations in exchange rates.

It’s the world’s largest financial market, with over $6 trillion traded daily. To learn forex trading as a beginner can open doors to a lucrative opportunity, provided you approach it with the right mindset and tools.

What Is Forex Trading

Forex trading is buying and selling different countries’ currencies to make money from changes in their values.

Think of it like exchanging money when you travel abroad, but doing it to make a profit. For example, if you exchange $100 for euros today and the euro becomes more valuable tomorrow, you could exchange it back for more than $100.

Why You Should Learn Forex Trading

Forex trading, or foreign exchange trading, is one of the most easy and accessible financial markets in the world.

With Forex Trading you don’t need a lot of money to start forex trading. Many brokers let you open an account with as little as $10. This makes it easier for beginners to try trading without risking too much money.

Reasons to Learn Forex Trading:

- 24/5 Accessibility

- High Liquidity

- Potential for High Returns

- Not Bound By One Exchange

Even if you don’t become a full-time trader, learning forex trading teaches you about global economics, risk management, and financial planning – skills that are useful in many areas of life.

6 Steps To Learn Forex Trading As A Beginner

Starting forex trading can be exciting, but it might feel overwhelming at first because you don’t know where to start or what to learn first.

The 6 steps to learn forex trading as a beginner are, step 1 understand forex trading basics, step 2 learn a trading strategy, step 3 backtest your trading strategy, step 4 choose a forex broker, step 5 become a consistent trader, and step 6 master your trading psychology.

Step 1: Understand Forex Trading Basics

Before you start trading, you need to understand some basic concepts. Don’t worry – we’ll explain everything in simple terms.

Currency Pairs

Currencies are always traded in pairs. The most traded currency pairs include:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- USD/CHF (US Dollar/Swiss Franc)

The first currency in the pair is called the “base currency,” and the second is the “quote currency.” When you see EUR/USD at a price of 1.20, it means 1 euro equals 1.20 US dollars.

Lot Size

In forex trading, a “lot” is simply a standardized unit that measures the amount of currency you buy or sell.

- The standard lot is the largest size, representing 100,000 units of currency presented by 1.

- Mini lot is 1/10th of a standard lot, or 10,000 units presented by 0.1.

- Micro lot is 1/100th of a standard lot, or 1,000 units presented by 0.01.

The lot size you choose affects how much your profit or loss will change with each movement in the exchange rate.

Pip Value

A pip is the smallest price change in forex trading. For most currency pairs, it’s the fourth decimal place. For example:

- If EUR/USD moves from 1.2000 to 1.2001, that’s one pip

- If you trade one standard lot ($100,000), each pip is worth about $10

- Smaller trade sizes mean each pip is worth less money

Spread

The spread is the difference between the buying price and the selling price of a currency pair. It’s how brokers make money. For example:

- Buy price: 1.2002

- Sell price: 1.2000

- Spread: 0.0002 (2 pips)

Leverage

Leverage lets you control more money than you have in your account. For example:

- With 1:100 leverage, you can trade $100,000 with $1,000 in your account

- This can increase both profits and losses

Be very careful with leverage – it’s one of the main reasons beginners lose money

Step 2: Learn A Trading Strategy

Developing a solid trading strategy is important for success in forex trading. Think of your trading strategy as your personal roadmap in the market, it tells you exactly when to enter trades, when to exit, and how to manage your risk along the way.

Trend Line Trading

Trend trading is often recommended for beginners due to its straightforward approach. This strategy involves identifying the overall direction of the market and using line trading to determine whether the price is in the upper line or downline

- Look for currencies that are moving steadily up or down

- If the price is going up (uptrend), look for opportunities to buy

- If the price is going down (downtrend), look for opportunities to sell

- Use trend lines to spot trends

The key principle behind trend line trading is “the trend is your friend,” meaning it’s often safer to trade in the direction of the prevailing market movement.

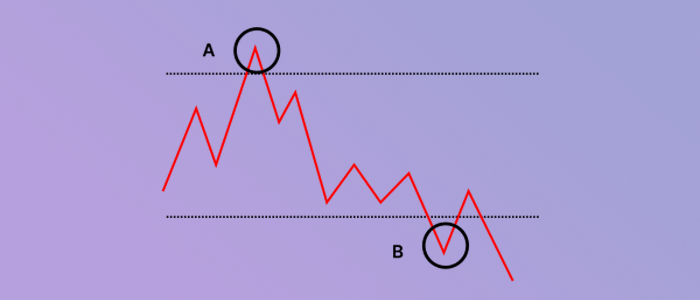

Support and Resistance Trading

This strategy focuses on identifying price levels where currencies tend to stop and reverse direction

- Support: A price level where the currency tends to stop falling

- Resistance: A price level where the currency tends to stop rising

- When the price reaches these levels, it often bounces back

These levels form natural points where traders can make decisions about entering or exiting trades.

Simple Moving Average Strategy

The simple moving average strategy provides a systematic way to identify trends and potential trading opportunities. By comparing moving averages of different time periods, traders can identify potential entry and exit points.

- Use two moving averages (for example, 20-day and 50-day)

- Buy when the 20-day moving average crosses above the 50 moving average

- Sell when the 30-day moving average crosses below the 50 moving average

When a shorter-term moving average crosses above a longer-term one, it might signal a buying opportunity. Conversely, when the shorter-term average crosses below the longer-term one, it might indicate a selling opportunity.

Smart Money Concepts (SMC)

Smart Money Concepts (SMC) refer to trading strategies that focus on following the actions of experienced traders, institutions, and large financial players (often called “smart money”).

- The idea is that if you can track where smart money is going, you can make better trading decisions.

- It uses Supply and Demand Zones

- Smart Money looks for places with high trading volume, as they can enter and exit trades easily.

The goal of SMC is to align your trades with these large players to increase the chances of success

Step 3: Baktest Your Trading Stratergy

Backtesting means testing your strategy on historical price data before using it with real money. Think of it like practicing a sport before playing in a real game.

How to Backtest

- Choose a time period (like the last 6 months)

- Look at historical charts for your chosen currency pairs

- Write down where you would have entered and exited trades

- Calculate how much money you would have made or lost

- Look for patterns in what worked and what didn’t

When I do my backtesting I use fxReply one of the best free backtesting tools. You can try it out if you want to backtest a strategy that does not use EAs

Important Backtesting Tips

- Test your strategy on different currency pairs

- Test during different market conditions (trending and ranging markets)

- Keep detailed records of your results

- Don’t ignore losing trades

Use my free notion template to create your backtesting journal and keep track of your backtesting records.

Step 4: Choose A Forex Broker

Your broker is like a gateway to the forex market. Here’s what to look for when choosing a forex broker:

Regulation

Make sure the broker is regulated in your country, and on other well-known regulators. For South Africans, your broker must be regulated with the FSCA.

Other well-known regulators are:

Trading Costs

- Compare spreads between brokers

- Check if there are any commission fees

- Look for hidden fees like withdrawal charges

- Consider minimum deposit requirements

Trading Platform

- Most brokers offer MetaTrader 4 or 5

- But If it Offers TradingView Interaction Then Perfect

- Try the demo version before committing

Step 5: Become A Consistent Trader

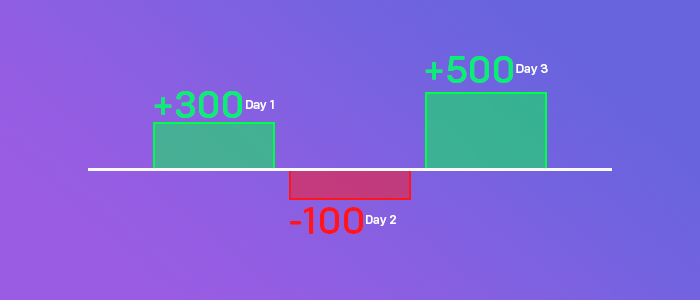

Consistency is more important than making huge profits, you don’t want to be making $1000 today and then lose $4000 tomorrow.

Here’s how to develop consistency:

Create a Trading Plan

- Write down your strategy rules

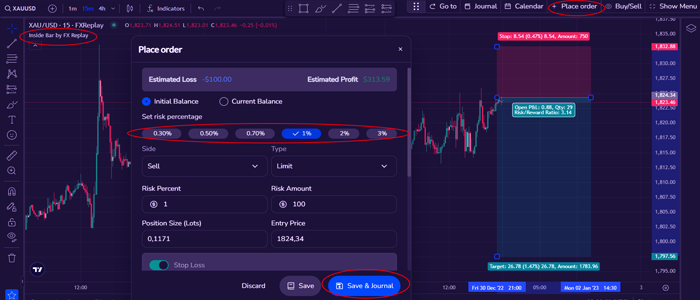

- Decide how much money you’ll risk per trade

- Set your trading hours

- List which currency pairs you’ll trade

Risk Management Rules

- Never risk more than 1-2% of your account on a single trade

- Always use stop-loss orders

- Don’t trade with money you can’t afford to lose

- Take breaks after losing trades

Track Your Progress

- Keep a detailed trading journal

- Record both winning and losing trades

- Write down your emotions during trades

- Review your journal weekly to find patterns

If you are struggling to create a trading journal I have one that I have created and giving out free free. Its a notion trading journal so grab it on the link below.

Step 6: Master Your Trading Psychology

Your mindset is just as important as your strategy, if you don’t get your mindset right you can struggle to succeed for years even if you have a working and profitable strategy.

Here’s how to develop a trader’s mindset:

Common Emotional Challenges In Trading

- Fear of missing out (FOMO)

- Revenge trading after losses

- Greed when winning

- Anxiety about losing money

How to Handle Emotions

- Start with small trade sizes to manage stress

- Take breaks when feeling emotional

- Focus on following your strategy, not making money

- Accept that losing trades are part of trading

Building Good Habits

- Trade at the same times each day

- Follow your trading plan strictly

- Don’t watch trades constantly

- Learn from both wins and losses

When you’re not trading, engage in activities that help you maintain a clear and focused mind. Physical exercise, meditation, or pursuing other hobbies can help reduce stress and improve your trading performance.

Conclusion

Learning forex trading as a beginner in 2025 requires dedication, patience, and a systematic approach to building your knowledge and skills.

While forex trading offers significant opportunities, it’s important to approach it with realistic expectations. Not every trader will become consistently profitable, and success requires significant dedication and discipline

Consider this guide as your starting point, and continue to build your knowledge through practical experience and ongoing education. Once you are profitable you can then look for funding from prop firm trading.

FAQ

Leave a Reply